Marketplace

Every weekday, host Kai Ryssdal helps you make sense of the day's business and economic news — no econ degree or finance background required. "Marketplace" takes you beyond the numbers, bringing you context. Our team of reporters all over the world speak with CEOs, policymakers and regular people just trying to get by.

Website : https://www.marketplace.org/

IPFS Feed : https://ipfspodcasting.net/RSS/395/Marketplace.xml

Last Episode : September 10, 2025 10:20pm

Last Scanned : 5.5 hours ago

Episodes

Episodes currently hosted on IPFS.

Why have some prices stayed put?

Why have some prices stayed put?Consumer prices have been overall slow to reflect the Trump administration’s new tariffs. So we called up some retailers to understand why they haven’t raised their prices, even though their costs are higher. It turns out, bumping up prices isn’t as easy as pushing a button — and can come with consequences. Also in this episode: Bond yields tell us where the economy’s headed, volatile categories can have an outsize impact on the PPI, and a new book investigates the “double tax” Black women face.

Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.

Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.

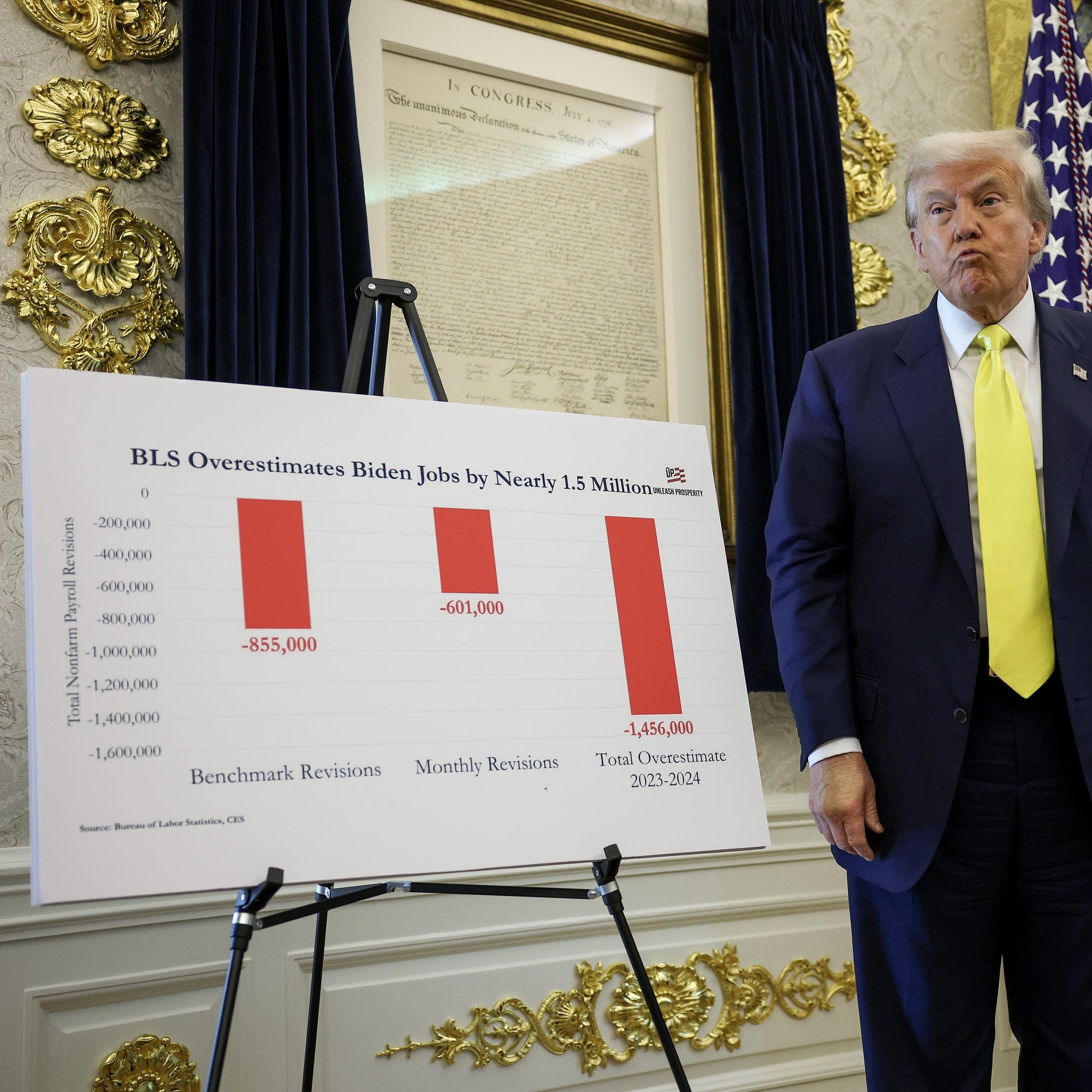

The BLS has a $700 million budget. What's its ROI?

The BLS has a $700 million budget. What's its ROI?Budget cuts may be in the Bureau of Labor Statistics' future. But the data collected by the BLS is critical for federal decision making. In this episode, we calculate if the $700 million investment is worthwhile. Plus: Firms that spend the most on AI slash tons of jobs, economic uncertainty drives up the price of gold, and mortgage rates fall — which is good for buyers but a bad sign for the overall economy.

Every story has an economic angle. Want some in your inbox? Subscribe to our daily or weekly newsletter.

Marketplace is more than a radio show. Check out our original reporting and financial literacy content at marketplace.org — and consider making an investment in our future.